Release of Office Property Market Semi-Annual Report of Shanghai in 2020

The COVID-19 epidemic spread across the world throughout the first half of 2020. Although the epidemic was contained earlier in China, economic activities in various cities were inevitably impacted to varying degrees, especially in the commercial real estate market. "Recovery" was the main keynote of the market in the first half of the year.

In terms of the performance of major cities, the eastern coastal cities represented by Shanghai, Hangzhou, Nanjing and Suzhou and the southern cities represented by Shenzhen and Guangzhou have shown strong resilience, and their economic and market recovery have also achieved more remarkable results.

Since the end of the first quarter, Shanghai has started to resume work and production comprehensively. The market has restarted quickly and all trading activities have resumed gradually and orderly.

Land Market

In the first half of the year, the pace of land supply in Shanghai market accelerated significantly. From January to June, a total of 24 commercial land plots were traded in Shanghai, and the overall supply volume has reached the level of the whole year of 2019.

In terms of regional distribution, the supply volume in the central urban area accounts for nearly 60%, and important plots have been transferred in Xuhui, Jing 'an, Putuo and Changning. In addition, the construction of Lingang New City has officially stepped into an accelerated stage. In the first half of the year, a total of 7 commercial-office plots were transferred, including 3 functional project clusters: east and west plots of Lingang 105 Financial Headquarters Bay, the main urban area of Lingang New City, and Shanghai International Cultural and Creative Park were all transferred, with a total supply of more than 700,000 square meters of office space. In the second half of the year, Lingang still has a large number of commercial lands to be transferred. In addition, the newly renovated Hongkou North Bund, Old Jing 'an Central District and Huangpu all have different number of key project plots transferred. In the second half of the year, the land auction market is bound to maintain the trend of the first half.

In terms of new planning, apart from the new planning of the North Bund and the new area planning of Lingang, which is the largest planning in Shanghai since this century, Putuo Zhenru, Baoshan Nanda, Pudong Jinqiao and other areas have added or adjusted a considerable volume of commercial office supply. The urban renewal of the city center has also turned into a fast lane, and key projects such as Jinling East Road in Huangpu and Fuyou Plot in Xintiandi have achieved nodal breakthroughs. From the current planning, the office market supply wave in Shanghai may last longer than expected with larger scale.

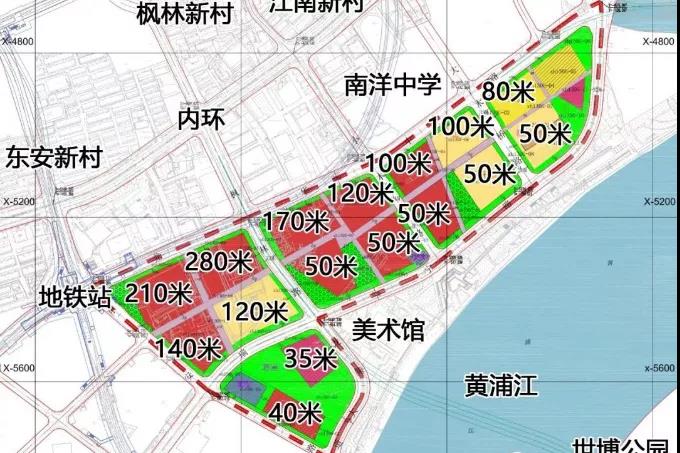

Key land transfer · Xuhui Binjiang

West Bank financial port land fell to Hong Kong Land

The total price of more than 31 billion has broken the record of land price in Chinese mainland

The total development volume of this huge plot reaches 1.8 million square meters, which will bring about 660,000 square meters of office space, 210,000 square meters of business space and 55,000 square meters of hotel space to the market. At the same time, this plot will also add a 280-meter-high building complex to Xuhui Binjiang.

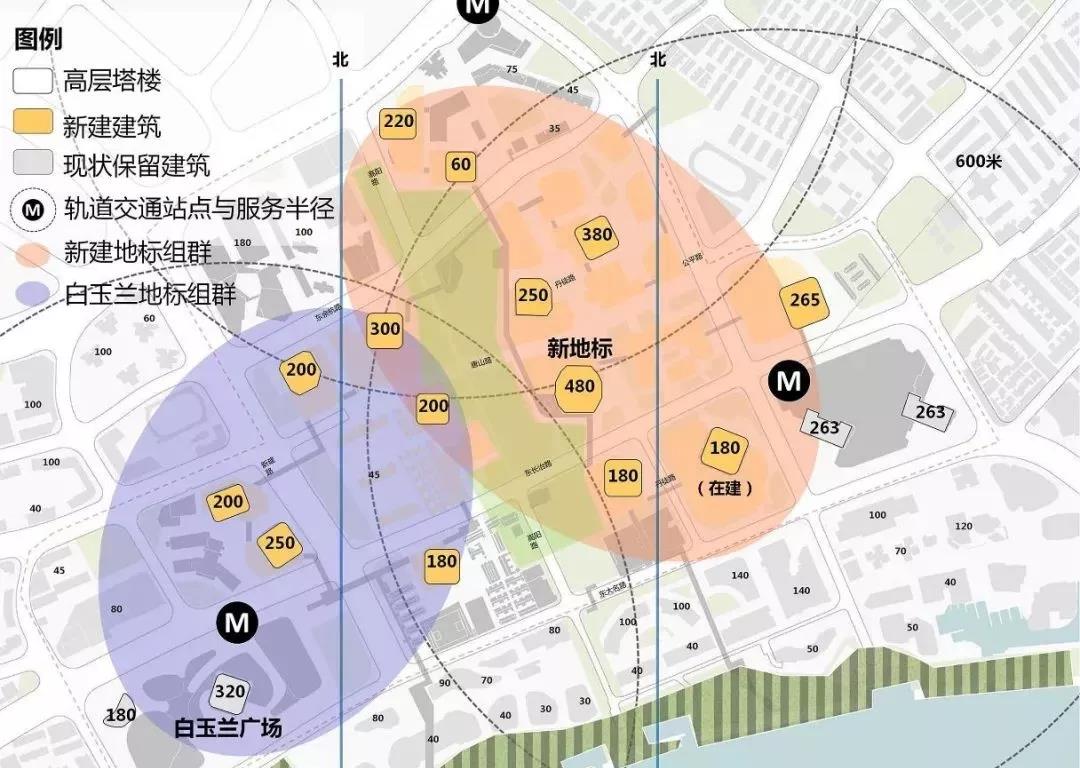

Key Planning Renewal · North Bund

Epic Planning

8.4 million square meters of development volume, 480 meters of Puxi new skyline

The new planning of the North Bund of Hongkou District, which has been brewing for a long time, was officially released in the first quarter. In the new round of planning, the North Bund has greatly improved its positioning and planned to be built into a new logo with the same energy as the Bund and Lujiazui in the new era. The overall development scale of the North Bund will be increased to 8.4 million square meters, with the construction of the highest building in Puxi with a height of 480 meters, as well as two levels of super high-rise buildings ranging from 300 to 380 meters and from 200 to 250 meters.

This plan can be described as the largest and most ambitious plan since Shanghai started the Lujiazui planning and construction in 1990. Some of the landmark commercial plots are expected to be leased within the year.

Leasing Market

In the first half of the year, a total of 517,000 square meters of new supply were added to the city's office leasing market, with a total of 9 projects listed, which are located in the Foreshore, Huangpu World Expo Binjiang, Pudong North Binjiang, Grand Hongqiao and New Jing 'an Pengpu. Affected by the epidemic, the listing time of some projects has been postponed. However, it is expected that in the second half of the year, Hongqiao Business District, North Bund, West Bank, Backshore, Suhewan and other areas will have a considerable volume on the market, and the total supply will exceed 2 million square meters.

With the gradual stabilization of the epidemic, the market leasing activities gradually recovered in the second quarter, the earlier pent-up demand was released, and the market activity increased significantly. But the net absorption recorded in the first half was still less than 20% of the same period last year. Due to the uncertainty of the macro environment, enterprises strengthen the cost orientation, postpone the expansion, adopt conservative leasing strategy, and the demand for flexible leasing increases. Based on this, hardcover office products and co-office products have attracted significant market attention.

In terms of regional selection, the non-core areas with sufficient supply volume and more cost-effective advantages (such as Foreshore and Grand Hongqiao) are more favored by the market. Faced with the severe market environment, owners generally choose to deal with the market by exchanging price for quantity. In the second quarter, the average rent quotation of the whole city recorded a sharp decline of 5% from the previous quarter.

New Supply Representative Projects in the Leasing Market in the First Half of 2020

Hongqiao Business District - R&F Global Center

Pudong Tangqiao · Lujiazui Binjiang Center

Retail Market

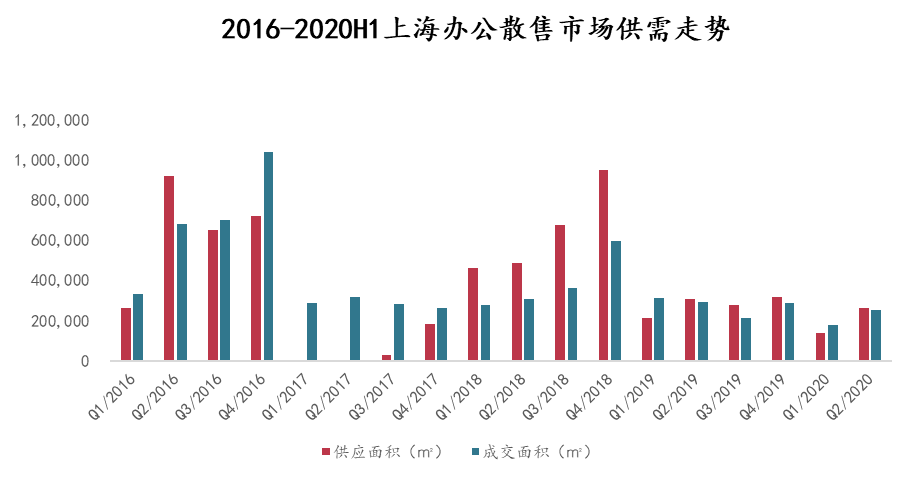

From January to June, a total of 20 projects were collected in the city, adding about 406,000 square meters of office supply to the market. The total supply decreased by 22% year-on-year, and the distribution was relatively concentrated in Minhang, Qingpu, Jiading and Huangpu districts.

On the demand side, in the first half of the year, the total volume of office transactions in the city was about 436,000 square meters. Although key projects in Huangpu South Bund, New Jing 'an Pengpu, Pudong Forebeach and Songjiang Jiuting all recorded concentrated transactions, the volume of transactions still decreased by 29% year-on-year. At the same time, the transaction of projects in the downtown area pulled up the city's average transaction price to RMB 53,805/square meter.

New Supply Representative Projects in the Sales Market in the First Half of 2020

Qingpu · Caohejing Zhaoxiang Park

Nanxiang · Sunac Xihuan Center

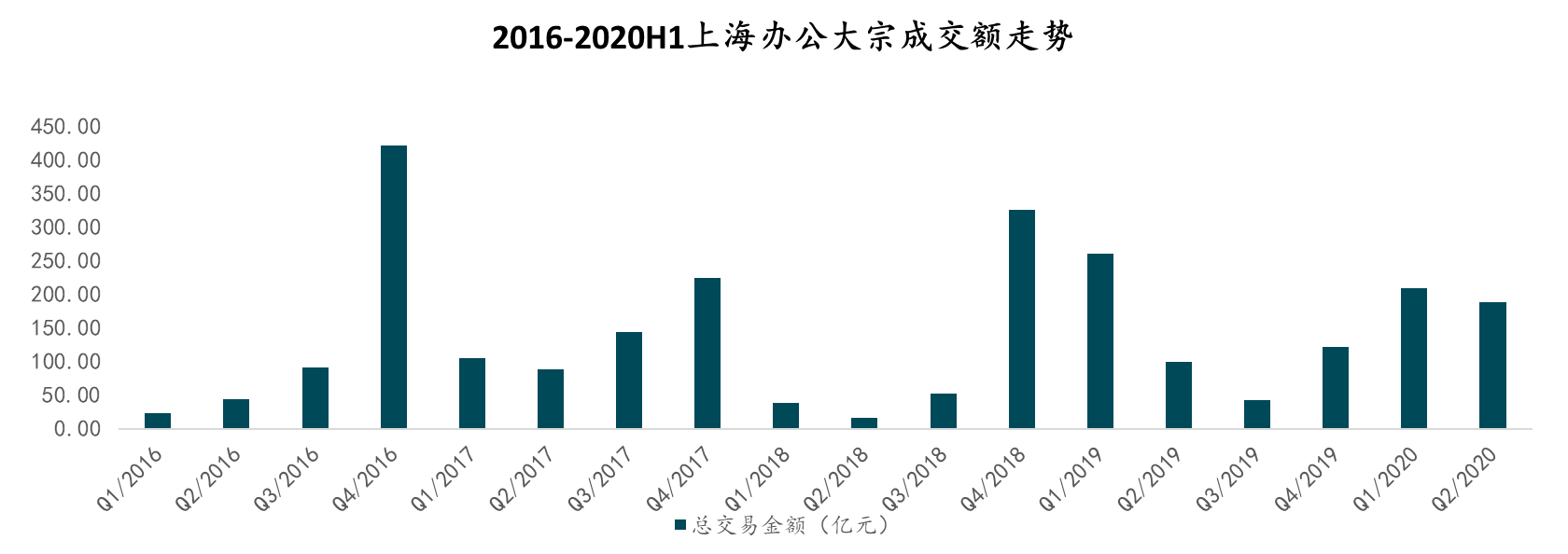

Block Trade Market

Compared with the retail market, the block trade market of office has been in a relatively high degree of activity. In the first half of the year, the city's block trade market of office recorded 13 transactions, with a total value of more than RMB 37 billion, basically the same with the level of the same period last year.

The epidemic in 2020, as a typical "black swan" event, brings great uncertainties to the market. However, from the perspective of the current development of the epidemic and its future trend, the office market in Shanghai is expected to become the focus of a large amount of funds to meet the demand of asset allocation.

On the other hand, under the dual pressure of economic environment and market development, the industry reshuffle of real estate enterprises is intensified. More real estate enterprises are under the pressure of cash flow and debt repayment, and they generally have a large bargaining space in the sale of assets.

Transaction Representative Cases of Block Trade Market in the First Half of 2020

Ping An acquired Huangpu Binjiang Gopher Center with RMB 4.267 billion

Changcheng Guofu Land sold Dapu Bridge Changcheng Financial Building for RMB 2.8 billion

Future Prospects

The leasing market is expected to recover further in the second half of the year as business activities resume, but only to a limited extent. Based on the market situation, the owners will continue to have a more flexible leasing strategy, and the market will further tilt toward the lessees.

The retail market remains focused on peripheral residential products. Due to the release of liquidity and improved financing conditions, it is expected to bring a new round of opportunities for the block trade market.

Report Writing | Strategy Research Department